PIE

Years ago I was an equity research analyst for an investment bank. My job was to find undervalued companies that had amazing products/services/tech. I read about an approach that made a lot of sense. And I used it as a rubric that was the basis of my analyses: Price Implied Expectations and Expectations Investing.

Briefly, this approach offers a reverse-engineered approach to equity valuation that starts with the current stock price and works backward to understand what future performance the market is pricing in. This methodology, popularized by Michael Mauboussin and Alfred Rappaport, provides a valuable complement to traditional forward-looking valuation approaches.

The core principle behind PIE analysis is that a company's stock price reflects the market's collective expectations about future performance. By decomposing these expectations into their key value drivers – primarily revenue growth, operating margins, and investment requirements – analysts can assess whether these implied expectations are reasonable or warrant skepticism.

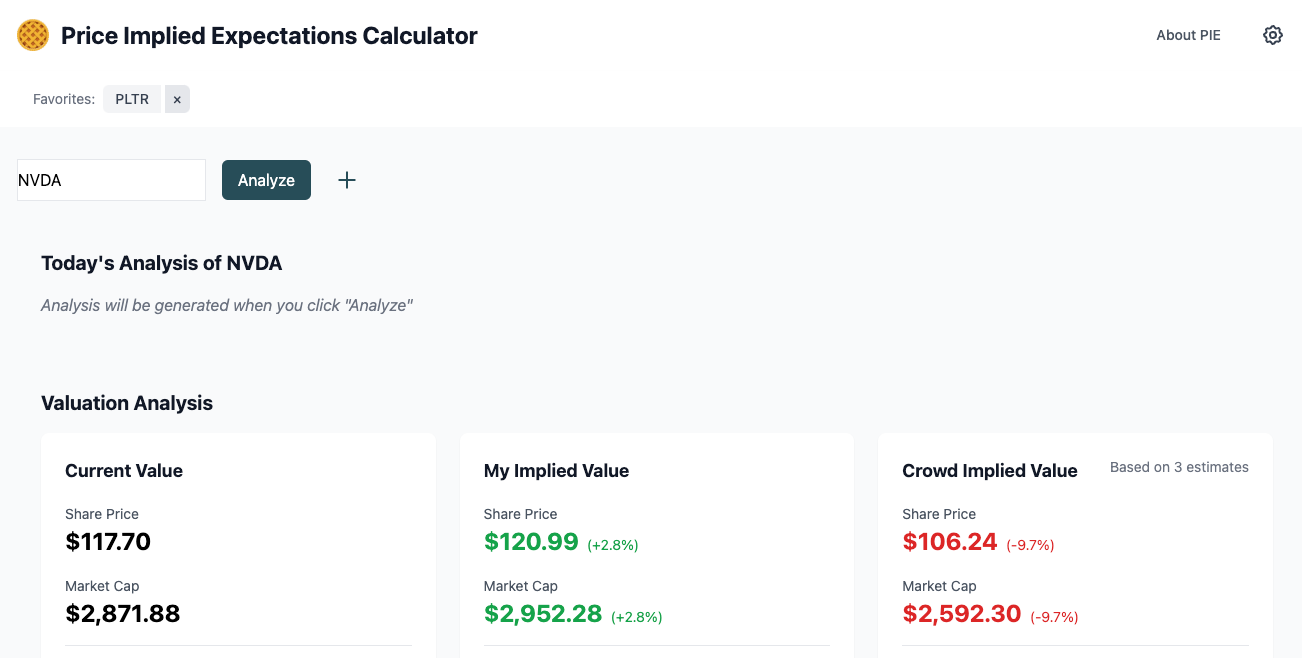

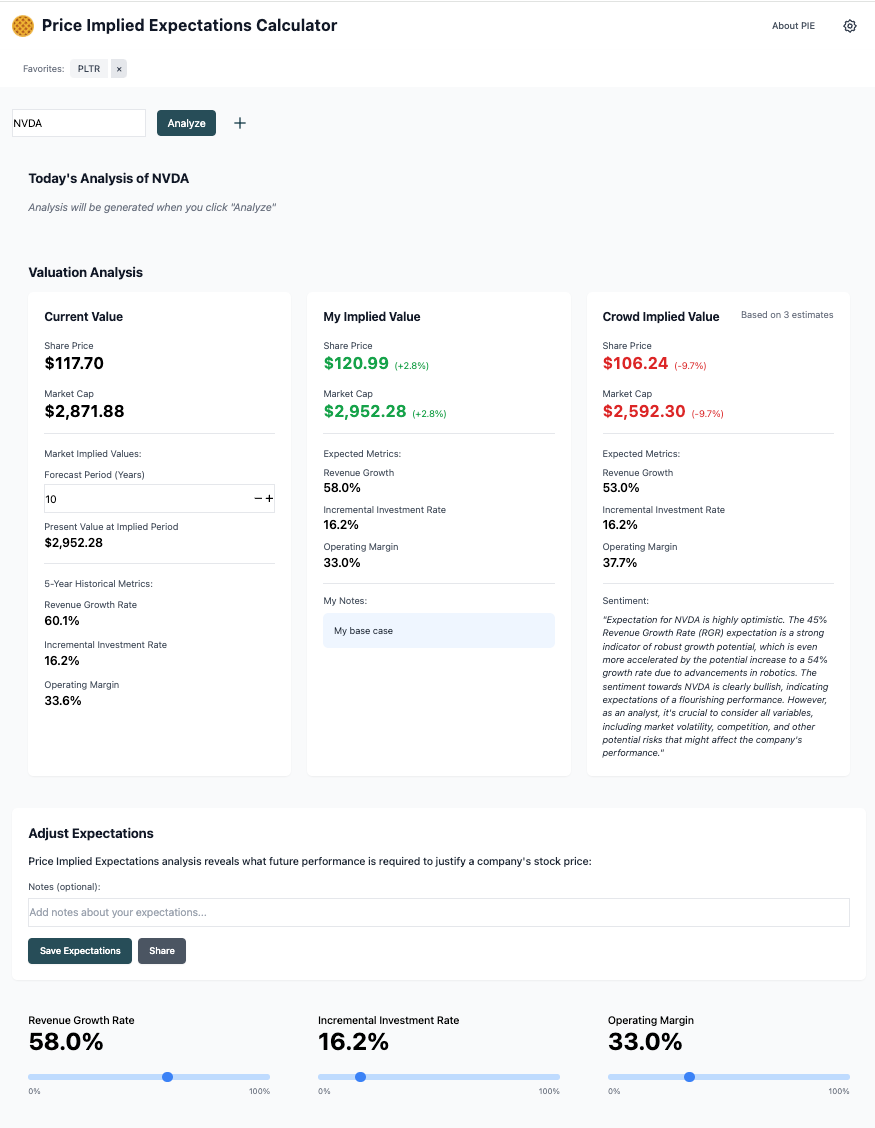

I had been reading and playing with a lot of python financial libraries/functions (and playing with Kaggle.com) and thought that it would be interesting to build a PIE financial calculator. You give it a ticker, it figures out the historical drivers of value and then allows users to assess their beliefs about what the expectations are for the company and then allows them to adjust the main value drivers (Revenue growth rate, Operating Margin and Investment Rate) to see how changes in those values could change the valuation of the company. I’ve also added some “Crowd” sourced aspects and AI analyses to it as well to give additional context to the calculator.

I’m still working on this, and tightening up the math. (Note, I’m using a simplified PIE model here to allow users to focus on the key valuation drivers) But I’d love to hear your feedback, both on the approach as well as what could make the calculator/app more useful. Right now it uses mock data as a default, but there’s a switch in the menu to use real data from a financial API.

Give it a try here: https://piecalc.app/

Resources: Bolt.new, alphavantage API for financial data.

TTC: 6-10 hours. A lot of iteration on the math.